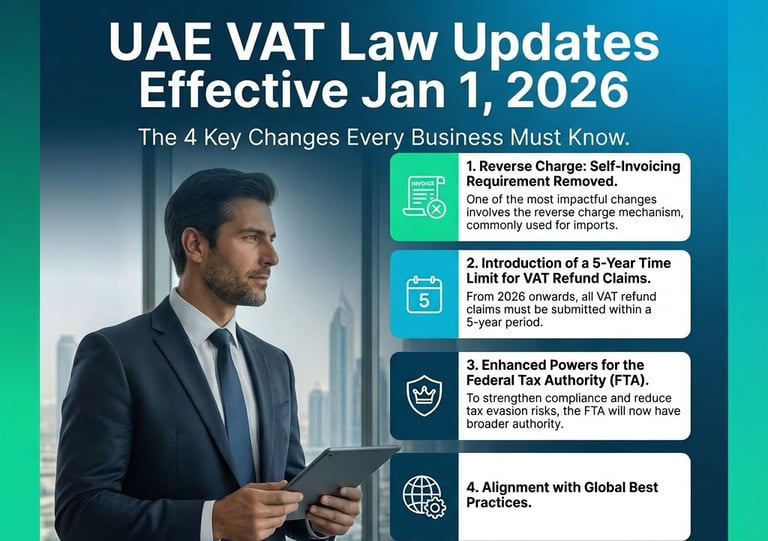

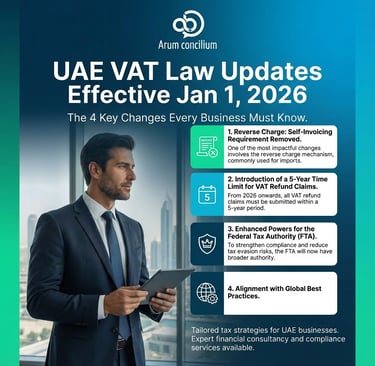

UAE VAT Law Updates Effective January 1, 2026 – Key Changes Every Business Should Know

12/5/20252 min read

UAE VAT Law Updates Effective January 1, 2026 – Key Changes Every Business Should Know

The UAE Ministry of Finance has announced significant amendments to the Value Added Tax (VAT) Law, set to take effect on January 1, 2026. These updates aim to streamline compliance, ease administrative burdens, and reinforce the integrity of the UAE’s VAT framework.

At Arum Concilium, we simplify these changes to help SMEs, corporates, and finance teams understand what’s ahead — and how to stay prepared.

1. Reverse Charge: Self-Invoicing Requirement Removed

One of the most impactful changes involves the reverse charge mechanism, commonly used for imports of goods and services.

What’s Changing?

Businesses will no longer be required to issue self-invoices for reverse charge transactions.

What You Must Maintain Instead:

Supplier invoices

Contracts

Shipping documents

Any other transaction-supporting records

This update significantly reduces administrative work and makes VAT documentation more practical and aligned with global standards.

2. Introduction of a 5-Year Time Limit for VAT Refund Claims

From 2026 onwards, all VAT refund claims must be submitted within a 5-year period, including:

Input tax recovery

Claims on outstanding credit balances

The goal is to encourage timely reconciliation and prevent old refund claims from remaining inactive for extended periods.

Action point: Businesses should review their historic VAT credits and ensure no long-standing amounts remain unresolved before the new rule takes effect.

3. Enhanced Powers for the Federal Tax Authority (FTA)

To strengthen compliance and reduce tax evasion risks, the FTA will now have broader authority to:

Reject input tax claims if a transaction appears suspicious or potentially linked to evasion

Request detailed supporting evidence

Carry out deeper compliance checks across supply chains

Companies must ensure that all suppliers, contracts, and transactions are authentic and properly documented before claiming input VAT.

This makes supplier due diligence more important than ever.

4. Alignment with Global Best Practices

The amendments reflect the UAE’s commitment to building a transparent, efficient, and internationally aligned tax environment—particularly as the country’s indirect tax and corporate tax frameworks continue to mature.

With these changes, the UAE further aligns its VAT system with global standards while improving overall compliance robustness.

What Should Businesses Do Now?

To prepare for the 2026 VAT updates, companies should begin reviewing their internal processes. Key steps include:

✔ Evaluate reverse-charge workflows

Especially for import-heavy sectors such as manufacturing, trading, logistics, and construction.

✔ Update VAT documentation and filing procedures

Ensure your accounting systems and ERP workflows align with the upcoming documentation requirements.

✔ Reconcile and clean up old VAT credit balances

Submit pending refund claims before the 5-year rule takes effect.

✔ Assess supplier reliability and transaction transparency

Implement stronger vendor checks and maintain well-documented contract files.

How Arum Concilium Can Help

At Arum Concilium, we support businesses in staying ahead of regulatory changes with clear guidance, risk mitigation, and hands-on implementation assistance.

Our VAT experts can help you with:

VAT compliance reviews

Reverse-charge mechanism assessments

Documentation and process improvements

Advisory sessions on the 2026 VAT updates

Need Help Understanding the New VAT Rules?

Reach out to us for a VAT health check or a tailored advisory session to ensure your business is fully ready for the 2026 transition.

Arum Concilium – Your Partner for Tax, Audit & Compliance Excellence.